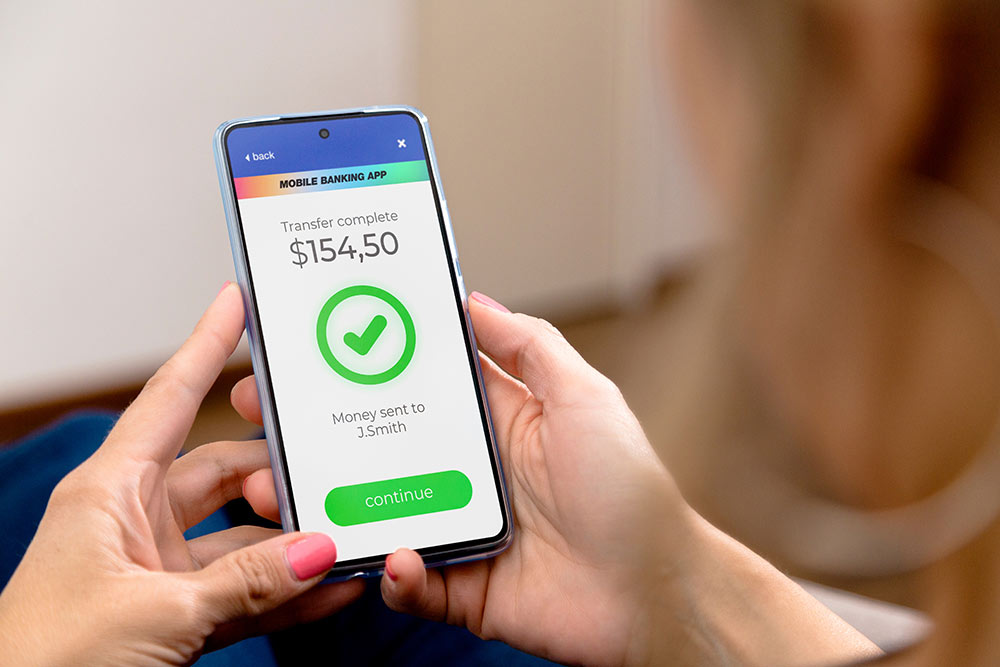

These services allow users to send and receive money quickly and easily, usually with just a few taps on a smartphone. Many of the apps even include social features that allow users to see recent transactions, make comments or even add emojis to make the experience feel more interactive.

Know the risks

- Fraudulent Transactions – Users may be targeted by scammers who impersonate legitimate contacts or businesses. Once money is sent, it can be difficult or impossible to get it returned.

- Account Takeover – If a user’s account is hacked, the attacker can potentially access funds and send money without the owner’s consent.

- Phishing Scams – Users may be tricked into providing personal financial information through phishing emails or messages that appear to be from the service providers.

- Lack of Buyer Protection – Many of these services do not have the same level of fraud protection as credit cards, so users have limited recourse for unauthorized transactions or disputes.

- Inadvertent Payments – User interface errors, such as sending money to the wrong person or entering the wrong amount, can lead to irreversible mistakes.

- Data Privacy Concerns – These apps often collect personal information and transaction data, raising questions about how that data is stored, used and shared.

- Inaccessible Funds – If there are technical issues or if the app goes offline, users may not be able to access their funds or send money when needed.

- Linking Bank Accounts – Connecting bank accounts or credit/debit cards to these apps poses risks if those accounts are compromised.

- User Behavior – Inexperienced users or those unfamiliar with digital payment systems may expose themselves to risks through oversharing personal information or neglecting basic cybersecurity practices.

Tips for enhanced security

Users should practice good security habits such as enabling two-factor authentication, regularly monitoring account activity, and only sending money to known and trusted contacts.

- Two-factor authentication (2FA) – Using two-factor authentication can enhance the security of your cash apps. Go to the security settings on your cash app and look for the option to enable 2FA. It may also be labeled as two-step verification. Choose your method: receive a one-time code via SMS (text), email, or an authenticator app like Google Authenticator or Authy). Ensure that 2FA is required every time you log in, especially when accessing the app from a new device or location.

- Passwords – Use strong, unique passwords for your cash app accounts that are at least 12 characters long combining letters, numbers and symbols and avoid using commonly guessable information such as birthdays.

- Keep your contact information updated – Make sure your email and phone number linked to the cash app is current.

- Monitor Account Activity – Regularly check your transaction history for unusual activities. If you notice anything suspicious, act immediately, such as changing your password or contacting customer support.

- Educate yourself about Phishing attacks – Be cautious about phishing attempts. Do not click links or provide personal information via email or text messages unless you are certain about their source.

- Limit Sharing of information – Be discreet with the information you share regarding your accounts. Avoid sharing sensitive details that could be used for unauthorized access.

- Log out after use – Always log out of the app after use and avoid using shared or public devices to complete money transfers.

- Consider using a credit or debit card – Certain transactions are more susceptible to fraud. They can include but are not limited to making a purchase, paying businesses for a service, purchasing something on Facebook Marketplace, sending money to the IRS, buying gift cards, or paying utilities. Consider using a credit or debit card to complete these transactions. Credit and debit cards offer more buyer protection with dispute processes if you think you have experienced fraud.

As a consumer it’s in your best interests to stay informed about fraud and practice good security when completing any type of money transfer.

Peake Federal Credit Union is here to help. Watch videos and read articles about the latest fraud scams at www.bcefcu.com. Click Financial Education> Money iQ. If you have questions about the safety of your account, contact Member Services at 410-828-4730, 800-234-4730 or [email protected].